How to provide all the required financial resources?

Base your financial plan at the end of the project and two years later, but give much more details for the first 12 months’ forecasts.

1. Assumptions

Include possible assumptions underlying your figures projection, both in terms of costs and revenues so as to clarify the thinking behind the numbers.

2. Sales forecast

The amount of money you expect to raise from sales

3. Cash flow statements

- Your cash balance and monthly cash flow patterns for at least the first 12 to 18 months.

- The aim is to show that your business will have enough working capital to survive, so make sure you have considered the key factors such as the timing of sales and salaries.

- Explain also individual costs such as; overheads, wages, equipment, legal, direct costs, loans, etc.

4. Profits and losses forecast

A statement of the trading position of the business: the profits you expect to make, given your projected sales and the costs of providing goods and services and your overheads.

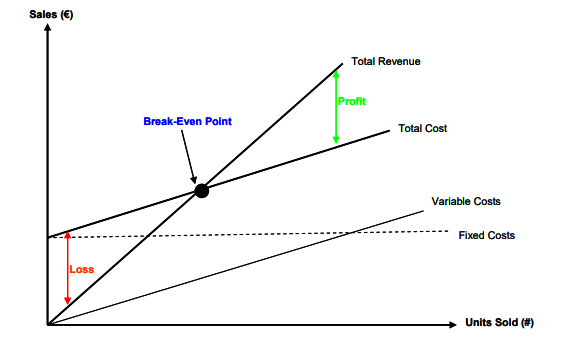

5. Break-even analysis

- The break-even point is the time when costs equal revenues and the costs are revenues values for this parity. Break-even analysis is a useful tool to provide a dynamic view of the relationships between sales, costs and profits for different price levels.

- In this section you should briefly explain what is going to happen before, during and after the break-even. A chart might also be useful.

6. Seasonality

In case your business is subjected to seasonality, explain the situation for the different phases of the cycle and provide a seasonality chart.

7. Scenarios

Your forecasts should include at least one worst and one best scenario, i.e. to include subsidiary forecasts based on sales being significantly slower/smaller or faster/higher than you are actually predicting.

8. Risk Analysis

Alongside your financial forecasts it is good practice to show that you have reviewed the risks your business could be faced with, and that you have looked at contingencies to cover such risks. Risks can include:

- Competitor action

- Commercial issues – sales, prices, deliveries

- Operations – IT, technology or production failure

- Staff – skills, availability and costs

9. Exit Strategy

Provide an exit strategy in case of business failure.

| References |

| 1. Business Plan: Financial Plan Summary, accessed October 2020, https://www.thebalancesmb.com/writing-the-business-plan-section-8-2947026 |

Leave A Comment?